Tax codes

ServMan uses the same Tax codes for both Accounts Receivable (clients) and Accounts Payable (vendors). You can assign up to four (4) default tax codes that can then be applied on client and vendor accounts. To set the maximum number of tax code fields you see in ServMan, select Utilities > Program Settings / Defaults > Misc Defaults.

Clients can be set up with default Tax codes so that each order created for the client will contain these codes. For more information on setting up Client Tax information, click HERE.

Default codes can be overridden at the client level by selecting new codes from the drop downs. These are located on the address tab.

The Client's default tax status and codes will populate their orders and can be overridden on the Advanced tab of the order.

Tax Exempt Status - Client

The tax exempt status is set on a client record's Misc tab. Click HERE for further information.

Tax Exempt Status - Item

The tax exempt status is set on the item record's Page 2 tab. Click HERE for further information.

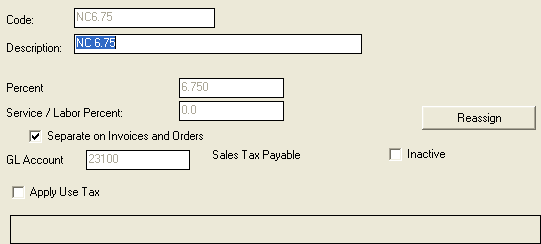

Create or Add a tax code

- Select Master Files > Miscellaneous > Tax Codes.

- Click New Code.

- Enter the tax code identification in the Code field. For state tax codes, it is recommended that you use the state abbreviation followed by the rate, NC7.0 for example.

- Enter the description.

- Enter the standard percent rate in the Percentage field.

- Enter the percentage rate for labor/service items in the Service/Labor Percent field.

- Enter the General Ledger account where sales tax receivables should post - this is generally an 'other current liability' type account. You must select a GL account even if you do not charge sales tax to your clients. (The default account for Accounts Payable and Purchasing is set in Utilities > Program Settings on the A/P Purchasing Settings tab.)

- Do NOT check the Apply Use Tax check box located here. This is legacy code that will be removed at a later date.

- Click OK.

back to top

Change the rate on a tax code

When a tax authority changes their tax rate, you also need to change the rate you charge. But, you cannot simply change the rate on your existing tax codes as this would affect historical tax information. Instead, you must create a new tax code with the new rates and reassign all instances of the old tax code to the new tax code.

- Select Master Files > Miscellaneous > Tax Codes.

- Create a new tax code with the new rates.

- Select the old tax code with the old rate and click Edit Code.

- Click the Reassign button.

- Select the tax code you created in step 2 in the New Tax Code dropdown.

- Enter the date the new tax code went into effect. -

- NOTE: If you need to generate recurring orders up to a certain date under the OLD tax rate, exit this procedure and complete process before updating to the new tax code.

- Press Start Update button to reassign the tax code on all clients; vendors; open work and recurring orders and invoices; and open purchase orders. The tax code is not changed on non-posted invoices; closed work and recurring orders and invoices; and A/P Vouchers.

- When complete, check the Inactive check box on the old code. If you have any non-posted invoices with this tax code you should post (update to A/R) before inactivating to prevent errors when during the posting process.

- Click OK.

back to top

Inactivate a tax code

- Select Master Files > Miscellaneous > Tax Codes.

- Select the code you want to make inactive and click Edit Code.

- Check the Inactive check box. If you have any non-posted invoices with this tax code you should post (update to A/R) before inactivating to prevent errors when during the posting process.

- Click OK.

back to top

Reassign a tax code

The reassign process scans the system for all instances of the tax code and will change the tax codes only on clients, vendors, open orders and recurring orders/invoices.

- See Change the Rate on a Tax Code above

back to top

Delete a tax code

Tax codes that have been used cannot be deleted. See Inactivate a tax code above

- Select Master Files > Miscellaneous > Tax Codes.

- Select the code you want to delete.

- Click Delete Code.

back to top

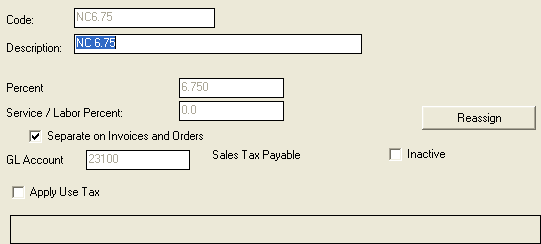

Tax codes options and field definitions

ServMan offers very robust tax features that make is easy to track sales and use taxes.

- Code: unique identifier for the tax code; maximum length is 10 alpha-numeric characters; the recommend format for the code is the state abbreviation follow by the rate

- Description: the description is displayed when selecting tax codes in the application; maximum length is 50 alpha-numeric characters

- Percent: the tax rate for material (non-labor) items

- Service/Labor Percent: the tax rate for service and labor items

- Separate on invoices and orders: indicates that the taxes for this tax code should be calculated separately on orders and invoices if more than one tax code is assigned; the normal behavior is sum the rates together then apply that to the sub-total on the invoice, but if this option is checked the tax amount is calculated separately then added to the tax amount

- GL Account: indicates the General Ledger (Chart of Account) account where the sales taxes should post; this is typically an Other Current Liability type account; this account cannot be masked

- Apply use tax: check this option if you pay use tax on materials you consume but do not bill clients directly for; when checked it exposes an additional GL account field for entering an expense or cost general ledger account; this account may be masked

- Inactive: indicates if the tax code is inactive

- Reassign: allows you to reassign the tax code on clients, open orders, recurring orders, recurring invoices, and vendors

See Also: Use Tax

back to top