|

What's covered? Hide |

For every action in the General Ledger in ServMan there is an equal and opposite reaction.

· Debits and Credits (Additions and Subtractions of Funds)

· Contra-Accounts

The General Ledger is composed of entries based off of accounts which fall into one of 2 types; Financial Statement Accounts or Balance Sheet Accounts:

Financial Statements (Income Statements)

Account Types:

- Income (Billed) Accounts

- Expense (Cost of Sales) Accounts

An Income Statement shows:

Revenue à Income

Cost of Sales (Expenses) à Top of the Section and Direct Cost of Income (Materials and Equipment)

Other Expenses à Administrative Fees, Utilities, Payroll etc.

Gross Profit à Income – Expenses

Balance Sheet (How the Business is doing as a Whole – Accumulated Wealth/Net Worth)

Account Types:

- Asset and Liability Accounts

o Assets are things like Cash, Cars, Inventory etc.

o Liabilities are things like Loans and AP

- Retained Earnings and Other Accounts

Balance Sheet Accounts are relieved in one of the below ways:

|

Method |

Accounts |

Result |

|

Taking Payments |

Cash |

INCREASE |

|

|

AR |

REDUCTION |

|

|

||

|

Selling Items |

Expense |

INCREASE |

|

|

Inventory |

REDUCTION |

|

|

||

|

Paying Bills |

Cash |

REDUCTION |

|

|

AP |

REDUCTION |

Using Generally Accepted Accounting Principles, or GAAP, standards for numbering General Ledger Accounts is a great idea. If your company has more than one Branch, you can lead the GAAP standard number with a number identifying the Branch. This allows you to sort your Chart of Accounts by Branch. For more Information, click HERE.

|

Start |

End |

Account Type |

|

Contra-Account |

Shown |

SM Type |

|

100000 |

109999 |

Cash and Other Bank Accounts |

Asset |

|

|

A1 |

|

110000 |

119999 |

Accounts Receivable |

Asset |

|

Balance Sheet |

A2 |

|

120000 |

139999 |

Inventory |

Asset |

Cost of Sales |

Balance Sheet |

A3 |

|

140000 |

149999 |

Other Current Assets |

Asset |

|

|

A4 |

|

150000 |

169999 |

Fixed Assets |

Asset |

|

|

A5 |

|

170000 |

189999 |

Accumulated Depreciation |

Asset |

|

|

A6 |

|

190000 |

199999 |

Other Assets |

Asset |

|

|

A7 |

|

200000 |

229999 |

Accounts Payable |

Liability |

|

Balance Sheet |

L1 |

|

230000 |

269999 |

Other Current Liabilities |

Liability |

|

|

L2 |

|

270000 |

299999 |

Long Term Liabilities |

Liability |

|

|

L3 |

|

300000 |

399999 |

Equity |

Equity |

|

|

|

|

|

|

Doesn't Close |

Equity |

|

|

E1 |

|

|

|

Retained Earnings |

Equity |

|

|

E2 |

|

|

|

Gets Closed |

Equity |

|

|

E3 |

|

400000 |

499999 |

Income |

Income |

AR |

Financial Statement |

S1 |

|

|

|

Other Income |

Income |

|

|

S2 |

|

500000 |

599999 |

Cost of Sales |

Cost of Sales |

|

Financial Statement |

C1 |

|

600000 |

999999 |

Expenses |

Expense |

AP |

Financial Statement |

X1 |

|

|

|

Other Expenses |

Expense |

|

|

X2 |

Account Masking helps to independently track and report income, cost of sales and expenses for multiple companies, Departments, Branches, or Warehouses in various States, yet still produce company-wide Cost of Sales and Financial statements. Account Masking also significantly simplifies the data entry process when keying items on a work order, purchase order, or invoice. For more information, click HERE.

Account Masking is best understood if you break the General Ledger Account number into segments representing a different instance of a particular category.

For example, the company has two Branches (Branch 01 is Charlotte and Branch 02 is Raleigh) and two Departments (Department 10 is the Service Department and Department 20 is the Installation Department).

General Ledger Accounts would be created for each Branch and Department combination. The actual GL codes would look like this: "4010-01-10".

|

Segment A |

Segment C |

Segment D |

Description |

|

Code |

Branch (BB) |

Department (DD) |

|

|

4010 |

01 |

10 |

Service Income - Charlotte |

|

4010 |

01 |

10 |

Installation Income - Charlotte |

|

4010 |

02 |

10 |

Service Income - Raleigh |

|

4010 |

02 |

20 |

Installation Income - Raleigh |

If you use account masking, you must setup a masking code for each Branch and Department. Using the example above, you would setup two (2) Branches: Charlotte and Raleigh. Charlotte would have a masking code of 01 and Raleigh would have a masking code of 02. You would also setup two (2) Departments: Service and Installation. The Service Department would have a masking code of 10 and the installation Department would have a masking code of 20.

Now in order to utilize GL Masking in fields which allow it, the GL Codes can be entered:

Code-BB-DD-00

Using the example above, the GL Code would appear "4010-BB-DD-00". Now when adding an item with a Masked GL to an Order or Invoice, the BB and DD will fill in according to the Branch and Department specified.

A masking code is used when entering the income and cost of sales accounts for items. Using the example above, your income account on items would be 4010-BB-DD. The same would apply for cost of sales and, in some cases, expenses.

STOCK Items -- By making an item a Stock Item, ServMan will:

1) Track your quantities on hand

2) Track quantities reserved by customer orders

3) Track quantities on order from your vendors.

When you Purchase a Stock Item you Debit your Cash Account and Credit your Inventory Account. Both are Asset Account Types so this balances out and does NOT hit the Income Statement. When a Stock Item is Sold you Debit your Inventory Account and then Credit your Cost of Sales Account.

ServMan also maintains an internal item cost table to allow tracking of item cost.

You can optionally choose to track the quantities for an item but have the item Expensed when purchased; such as a Consumable like Shoe Covers or Paper Towels. This is accomplished by un-checking the Update to COG's check box on the item setup.

Creating a STOCK Item

1) Fill in the Item No. field and select Stock Item from the Type drop down menu

2) Enter a Description and Extended Description and Manufacturer (if applicable)

3) Check the Update COGS box – Unless this is a CONSUMABLE item

4) Make sure the GL Account Information is as below:

|

GL Account |

Start |

End |

Account Type |

SM Field |

|

GL Inventory Account |

120000 |

139999 |

Inventory |

item.GLCODE_INP |

|

Income Account |

400000 |

499999 |

Income |

item.GLCODE_INC |

|

GL Cost of Sales Account |

500000 |

599999 |

Cost of Sales |

item.GLCODE_COG |

NON-STOCK Items -- Non-Stock items are items that you may use frequently, but don’t need ServMan to track the on hand quantities. Having a Non-Stock item in your item file makes it easier for you when you are entering a Quote, Order, Invoice or Purchase Order. All you have to do is enter the item number and ServMan will fill in the rest of the information.

When you Purchase a Non-Stock item it is expensed and when you Sell the Non-Stock Item the Cost is ignored.

Creating a NON-STOCK Item

1) Fill in the Item No. field and select Non-Stock Item from the Type drop down menu

2) Enter a Description and Extended Description and Manufacturer (if applicable)

3) DO NOT CHECK the Update COGS box

4) Make sure the GL Account Information is as below:

|

GL Account |

Start |

End |

Account Type |

SM Field |

|

Income Account |

400000 |

499999 |

Income |

item.GLCODE_INC |

|

GL Expense Account |

600000 |

999999 |

Expenses |

item.GLCODE_INP |

***If this is a NON-STOCK Item where you want to track the quantities on-hand (for example what is in a WILL CALL Warehouses) please follow the below instructions***

1) Fill in the Item No. field and select Stock Item from the Type drop down menu

2) Enter a Description and Extended Description and Manufacturer (if applicable)

3) Check the Update COGS box – Unless this is a CONSUMABLE item

4) Make sure the GL Account Information is as below:

|

GL Account |

Start |

End |

Account Type |

SM Field |

|

Income Account |

400000 |

499999 |

Income |

item.GLCODE_INC |

|

GL Expense Account |

600000 |

999999 |

Expenses |

item.GLCODE_INP |

|

GL Cost of Sales Account |

500000 |

599999 |

Cost of Sales |

item.GLCODE_COG |

To access the General Ledger Codes click Chart of Accounts on the General Ledger Navigator. You may also select Master Files > Chart of Accounts.

Click Chart of Accounts on the General Ledger Navigator. You may also select Master Files > Chart of Accounts.

Click New Code à Enter the requested information à Click OK.

You cannot change an account from a balance sheet account to an income statement account or vice versa once a transaction has posted to the account. Also, you cannot change the type of the General Ledger Account has a parent account assigned.

Click Chart of Accounts on the General Ledger Navigator. You may also select Master Files > Chart of Accounts.

Select the code à Click Edit Code à Edit the information as needed à Click OK.

Make a Non-Posting General Ledger Account

A non-posting account is one that transactions cannot post to. These are often created to serve as roll-up accounts when printing financial statements.

Add a new account or edit an existing account à Check the “Is a non-posting account” option à Click OK.

Set a General Ledger Account to Inactive

Edit the account à Check the Inactive check box à Click OK.

Delete a General Ledger Account

You cannot delete an account that has transactions posted to it as this would affect your historical financial information. Instead, you can set the account to inactive, which will prevent future transactions from posting to it.

Click Chart of Accounts on the General Ledger Navigator. You may also select Master Files > Chart of Accounts.

Select the code à Click Delete Code à Click Yes to confirm to deletion.

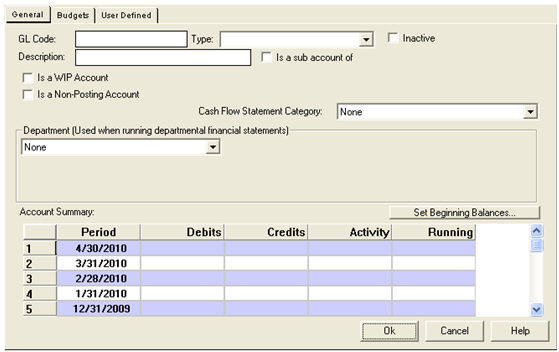

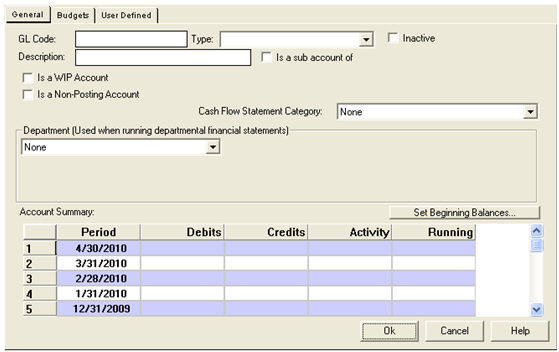

There are two (2) tabs for settings/options on General Ledger Accounts: General and Budgets. The General tab contains basic information about the account and the Budgets allow you to set budget information.

GL Code: A unique identifier for this account; cannot include the characters B, D, S, T, or W

Type: Determines chart of account type for the account

Inactive: Makes the General Ledger Account inactive, which prevents transactions from posting to the account

Description: description for the GL Account

Is a sub account of: Allows you to set the parent account; used for reporting purposes

Is a WIP Account: Allows the user to manually manage postings into WIP accounts without our optional WIP module; the rules for balances in WIP accounts apply to jobs whether or not the WIP module is turned on or not

Is a Non-posting Account: Identifies the account as a non-posting account, which prevents transactions from post

Cash Flow Statement Category: Sets the category where the account will appear on the Cash Flow Statement

Department: Identifies the Department the account should appear in when running Departmental financial statements; the account can be split across multiple determines by percentage if you select "Split across multiple Departments" then enter the percentage that should be allocated to each Department

Set Beginning Balances: Allows you to set the beginning balance in the account

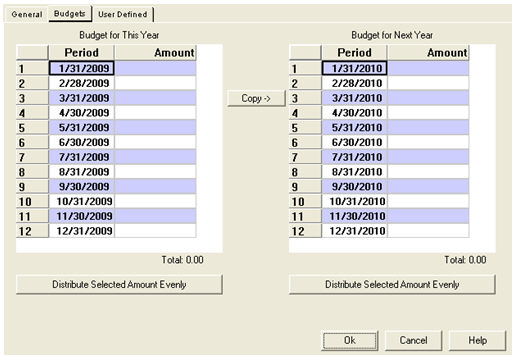

Budget for this Year: Allows you to enter budget amounts by accounting period for the current year

Budget for next Year: Allows you to enter budget amounts by accounting period for next year

Copy: Copies the current year budget to next year

Distribute Select Amount Evenly: distributed the amount in the selected evenly among the periods the period for that year; for example, period 1/31/2009 has $120,000 enter, you select the amount click distribute and each period would then have $10,000

Certain ServMan Transactions impact the General Ledger while others do not. They can be categorized into 2 types: Income and Cost

· Posting Invoices to AR

o Stock Items on Invoice

§ Income

· Income and AR GL Accounts

§ Cost

· Inventory and Cost of Sales/Expense GL Accounts

o Non-Stock Items on Invoice

§ Income

· Income and AR GL Accounts

§ Cost

· Ignored – No Effect on GL as these Items were Expensed at Purchase

· GL Entries -- Manual adjustments to the General Ledger requiring BOTH a Debit and a Credit (GJ in ServMan)

o Based on the Account Type being used in the Journal Entry, the Debit and Credit may be a positive or a negative value:

|

Account Type |

Entry |

Value |

|

Asset |

Debit |

Positive |

|

|

Credit |

Negative |

|

|

||

|

Liability |

Debit |

Negative |

|

|

Credit |

Positive |

|

|

||

|

Capital |

Debit |

Negative |

|

(Net Worth) |

Credit |

Positive |

|

|

||

|

Expense |

Debit |

Positive |

|

|

Credit |

Negative |

|

|

||

|

Revenue |

Debit |

Negative |

|

(Sales of Income) |

Credit |

Positive |

· Amortization Entries (JAT in ServMan)

o Deferred Revenue that is posted when the work is done to show Cost

o PM Agreements and Warranty Jobs

· Post Stock Items to COGs from Orders

o Item Costing:

|

Costing Method |

Description |

Item Cost |

|

LIFO |

Last In First Out |

Newest Purchased Item Cost |

|

FIFO |

First In First Out |

Oldest Purchased Item Cost |

|

Average Cost |

Average Cost of All Purchases |

Average Cost of All Purchases |

· Post Invoices (Stock or Items w/COGs NOT Checked) to AR

· Receiving PO’s (Non-Stock Items or Items w/COGs NOT Checked)

o Purchase Orders do NOT affect the GL. The Receipt of a PO creates an AP Bill which affects the GL

§ Cost (Contra-Account = AP)

§ Stock Items on PO should have an Inventory GL in the Detail Line

§ Non-Stock Items on PO should have a Cost of Sales or Expense GL in the Detail Line

· Inventory Adjustments, Stock Variance Transactions etc.

o Must set 2 Accounts (Inventory and Cost Variance)

· Writing Checks Directly to Expense Accounts

The term General Ledger Out of Balance refers to:

1) Instances when the Sub-Ledgers do not equal the General Ledger

2) Asset and Liability Accounts are not Equal – They should ALWAYS be the SAME

|

Sub-Ledger |

SM Table |

Report Run |

|

AR |

ar |

A/R Aging by Post Date |

|

AP |

aphdr |

Aged Payables |

|

Inventory |

invent |

Inventory Valuation by Date |

Most causes of an Out of Balance Issue are caught by the software; however, if the Balance Sheet is Out of Balance it could possibly be due to a bug in the software and should be brought to ServMan Support for further review.

While an Out of Balance can be caused by many different scenarios, below are some common causes based on sub-ledger:

· AR Account on an Invoice is NOT the actual AR Account

o Ex. An Invoice Aging Report shows that a client owes $200 but the AR GL shows $0

· AR Account GL placed on the Detail Line of an Order/Invoice

o Ex. Sell an item for $200 and set the detail GL to an AR Account. The Invoice books to AR for $200 and the Item also books to AR for $200. The AR GL will show $400

· Refund Check to Client – Detail line GL on Check is NOT the same AR Account as the Client. The off-setting credit will reduce AR for a value never posted to AR. AR will be OOB by the amount of the credit.

o Ex. Client GL is Branch 02 but Check Detail GL is using Branch 01

· Wrong AP Account is placed on an AP Bill – AP Aging does not match the GL Balance (Can occur as the result of AP Credit Card Import errors)

· Changing a PAID AP Bill (Blocked in Current Version of ServMan)

· Journal Entries

· Placing the wrong GL Account on receiving detail lines of AP Bills

o Ex. Expense on “Stock” or “Inventory Account” on Non-Stock Items

· Inventory Adjustments – Using the wrong GL Accounts

o Ex. Using the Inventory Account twice